NGO Registration – Trust and Society

Trust or Society is a form of NGO (Non-Government Organization) that works for the welfare of art/religion/cultural heritage for underprivileged and backward class. These units do not operate to gain any commercial profits. To begin your venture in these forms of NGOs, firstly you should fulfil the desired Registration eligibility. It’ll be faster and easier for you to complete the process when you avail our Trust/Society Registration Package. We’re known for providing the genuine service in this are since a long time. Go through its details and know how it works THE BEST.

Trust/Society Registration in India – An Overview

Apart from aiming for commercial success, if an enterprise is formed by a person/group of people for the purpose of motivation, development and welfare without looking for profit, formation of Non-Government Organizations (NGO) is an option for them to contribute to the society and our country. In India, NGOs work to attain a number of noble causes, such as:

- Social Service

- Arts, Culture and Humanities

- Education

- Environment

- Animal-Related

- Health Care

- Mental Health, Substance Abuse

- Diseases, Disorders and Medical Discipline

- Medical Research

- Crime and Legal

- Employment

- Food, Agriculture and Nutrition

- Housing

- Public Safety, Disaster Services

- Recreation and Sports

- Youth Development

- Human Services

- National, National Affairs and National Security

- Civil Rights, Social Actions and Advocacy

- Science and Technology

- Social Science

- Public, Society Benefits

- Old Age Welfare Programmes

- Women Welfare Programmes

- Skill Development and Livelihood Programmes for Women

- Person with Disability/Physically Challenged Persons Welfare Programmes

- Religion

- Mutual, Membership Benefit

- Other Social Welfare Programmes

Since, NGOs do not work for gaining any profit and their mission is to utilise their fund and resources to achieve certain welfare/development, they are called as Non-Profit Organizations (NPOs).

As per World Bank, NPOs are defined as ‘Private Organizations that pursue activities to relieve suffering, promote the interest of poor, protect the environment, provide basic social services or undertake community development.’

Note : In India, several NGOs are working for the above stated purposes that are either registered or unregistered.

NGO TRUST - REGISTRATION PROCEDURE

NGO TRUST - ITS PURPOSE

A Trust can be formed by at least two trustees, where members of family (one or more) can also be included (although in some cases, Government Ministries of India/Department and Funding Agencies can refuse funding a trust consisted of same family members). It is formed with a welfare/religious purpose and can operate throughout India. Trust is formed with a sanction of Trust Deed, an advisory element for functioning/operating the trust for the reason it has been established.

NGO TRUST FORMATION AND FEATURES

Types of Trusts: Public (built with common public for general welfare) or Private (built with closed groups, like, family members/individuals for specific welfare purpose)

Law/Act Applied to Register: Indian Trusts Act/Bombay Public Trusts Act (No National Law governs Public Charitable Trusts in India but States have Public Trust Acts)

Registering Authority of Trust: Sub-Registrar of Registration/Charity Commissioner

Time of Trust Formation: 2 days to 1 week

Trust Governing Structure: General Body/Board of Trustees, Executive Committee/One General Body of Trustees

REGISTRATION OF NGO TRUST

A Trust Deed should be prepared for this purpose, where the author of the Trust has to mention the following:

- Intention to create a Trust

- Purpose of the Trust

- Beneficiary

- Trust Property to transfer to the trustee (unless declared by Will/Author is himself the Trustee)

Final Deed is printed on a non-judicial stamp paper to present before the Sub-Registrar Office in the concerned jurisdiction area in presence of all the trustees and two witnesses. A Government Registration Fee is to be deposited for this purpose.

Benefits of Trust Registration

- Provision of Government approved land

- Grant allowed from Government

- Recognition/Affiliation from any University/Organization

- Income Tax Benefit

- 80 G Benefit

- Benefits of Entertainment Tax

- Benefits of Service Tax

- White money for building construction

Etc....

Note: A Trust should procure 12A Certificate from the Income Tax Department, which is a paper that allows the surplus income of the Trust exempted from Tax for the lifetime. Also, they are to get registered to be included under 80 G tax deduction provision.

NGO Society - Registration Procedure

NGO SOCIETY - ITS PURPOSE

Society is created as an association of persons (at least 7) connected together by mutual consent to deliberate, determine and act jointly for some common charitable cause, such as, education, religion, art, sports, etc. Foreigners, Companies and other Registered Societies can also subscribe in the Memorandum of a Society. Societies that are formed in India are controlled under the regulations of Societies Registration Act, 1860.

NGO SOCIETY FORMATION AND FEATURES

Law/Act Applied to Register: Societies Registration Act, 1860

Registering Authority: Registrar/Deputy Reg. Of Societies of the concerned State/Charity Commissioner

Time of Society Formation: 1-2 Months

Governing Structure: General Body, Executive Committee

REGISTRATION OF NGO SOCIETY

Society registration is managed by State Governments. Accordingly, Application of Registration of a Society must

be made to the concerned authority of the State, in which the Registered Office of the Society is to be located.

Procedure followed for the purpose of registration:

- Founding Members agree on the Society’s Name.

- Memorandum, Rules and Regulations of the Society are chalked out.

- Founding Members sign and validate the Regulations.

- Oath Commissioner, Notary Public, Gazetted Officer, Advocate, Chartered Accountant Class Magistrate should witness with their stamp duty and complete address.

- Memorandum is submitted to the Office of concerned Registrar of Societies in the State with a registration fee for the purpose of registration.

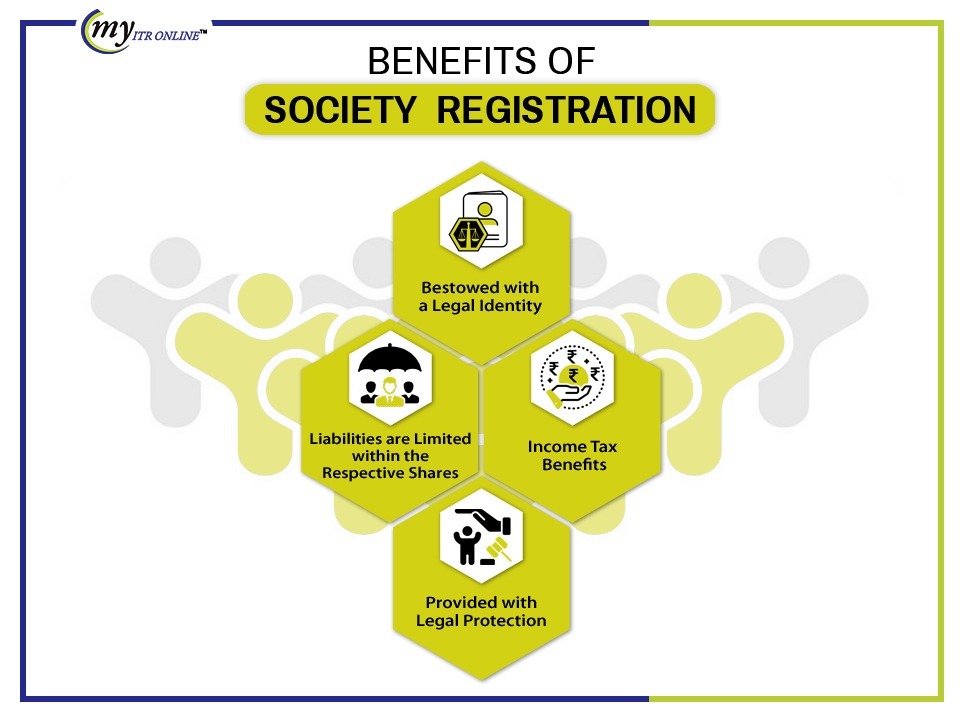

Benefits of Society Registration

- Bestowed with a Legal Identity. Members of a Society should follow certain regulation to conduct their activities.

- Liabilities are limited within the respective shares of the members following the legal decorum.

- Income Tax Benefits

- It is provided with Legal Protection to conduct its activities. Unauthorized use of Society’s name is a legal offense.

Etc.....

FAQs of Trust and society

No. Trust and society are not the same. Both are disparate from each other. A trust is managed by several parties where one party holds the assets for the benefit of another party. Society is a group of many people who come together for a common purpose.

There are several benefits of registering trust which is following- Trust can avail the income tax benefits. Benefits under section 80G. Provided money for building construction. Get recognition from the university. Government-approved land under provisions.

The consumed time in trust formation is between 2 days to one week.

Following are the essential documents for the registration of a trust- Copy of the Aadhaar card of each party included in a trust. Passport-sized photographs of all the parties of the trust. Identity proofs such as driving license, Passport, and voter ID. Most importantly trust deed and purpose.

There should be a minimum of 2 members to form a trust and there is no prescribed extent of maximum members in a trust.

There are certain steps to form a new trust which are mentioned below- Firstly, go to your local registrar and submit a trust deed as well as a photocopy of the registration. The photocopy of the trust deed must consist of the settler’s signature on each page. At the time of registration, A settler and two members must be present with their original identity proof.

The formation of any society can take a period of 1 to 2 months. It depends on the association connected with people’s consent and purpose.

The registration of the society is handled by the State Government. Following are the steps for the registration of an NGO society. All the members should be agreed on the name of the society. Rules and regulations should be chalked out already. Signature of the society’s founders. The memorandum must be submitted to the office of the registrar of societies in the state for the purpose of registration.

There are several benefits of the society registration which are mentioned below- Purchasing the property without any legal problems. Can file cases on account of any dispute. Holding fewer liabilities. Accumulation of funds from outside. You can avail of tax exemption from income tax.

Our Customers Admire What We Do

I have been dealing with Myitronline and Gopal Varshney for over a decade now. The firm is highly professional, prompt, efficient and courteous. Its been a pleasure dealing with Gopal and I would highly recommend his services. Keep up the great work !!See More Testimonials

Thanks guys!.