Filing of Income Tax Return

ITR is a mandatory task for any individual/entity over the taxable income earned per Financial Year. Based on different income head as categorized under Income Tax Act, 1961 the taxpayer has to pay the tax and file the connected IT Return within due date. Violation of this rule may result in Penalties/Notices/Legal Charge, etc. We’re the Government Registered agency to do your Income Tax Filing with NO chance of any risk or delay. Leave your tax filing stress and choose our ITR Package to get 100% assured result and huge benefits, as applicable. Go through its details and know how it works THE BEST.

Filing Income Tax Return (ITR) in India - An Overview

Government of India collects tax on income earned in this country based on certain criteria that is termed as Income Tax. This kind of tax comes under Direct Tax category with its rules and regulations described in Income Tax Act, 1961. Anyone who is liable to pay income tax should file Income Tax Return (IT Return) providing necessary income related details, such as, income, investment, deductions, contributions, etc. to submit in India’s Income Tax Department. As per Government Guidelines, earning people in India belonging to the given classifications, are considered to be taxpayers:

- Individual

- Hindu Undivided Family (HUF)

- Body of Individuals (BOI)

- Association of Persons (AOP)

- Local Authorities

- Corporate Firms

- Companies

- All Artificial Juridical Persons

When we’re talking about Income Tax liabilities applicable in India, we should let you know about the acceptable income sources where income tax is levied.

There are five income heads as defined to be recognized in Indian Law:

- Income from Salaries: Salaried income as mentioned in Section 192 of Income Tax Act.

- Income from Capital Gains: Income from selling capital assets, such as, buildings, lands, bonds, jewelries, etc.

- Income from House Property: Income through renting a house, space, etc.

- Income (Profits) from Business: A fixed part of business’s profit as mentioned in Section 30 and 43D of Income Tax Act.

- Income from other sources: Lottery, Dividend, Pension, Gifts, etc.

Note: Income Tax is calculated based on Rate Slabs that may change according to decisions taken by Finance Ministry and Tax Departments.

TYPES OF ITR FILING BASED ON INCOME HEADS

Income Tax Return is allowed to be filed by any earning entity irrespective of whether the income comes under tax liability or not. For income taxpayers, timely IT Return Filing is mandatory, otherwise, can lead to penal charges. To separate the income sources, IT Department issues specific IT Return Forms:

- ITR Form 1: Income from regular salary/pension/income from property/others

- ITR Form 2: Income of any HUF member NOT from Income (Profits) from Business income head

- ITR Form 3: Income of any HUF member from Income (Profits) from Business income head

- ITR Form 4 (SUGAM): Income of any HUF/Individuals included in SUGAM taxation scheme as per section 44AD/AE/ADA

- ITR Form 5: Income of LLPs, BOIs, APIs, artificial judiciary persons, local authorities

- ITR Form 6: Those companies claiming no exemptions as per Section 11

- ITR Form 7: Income based on filing done as per Sections 139 (4A), 139 (4D), 139 (4C), 139 (4B)

- ITR Form V: To acknowledge the Return Filing (ITR Verification)

DOCUMENTATION FOR ITR FILING IN INDIA

These information are essential at the time of making IT Returns:

- Permanent Account Number (PAN)

- Aadhaar

- Bank Account Details

- Form 16

- Investment Details

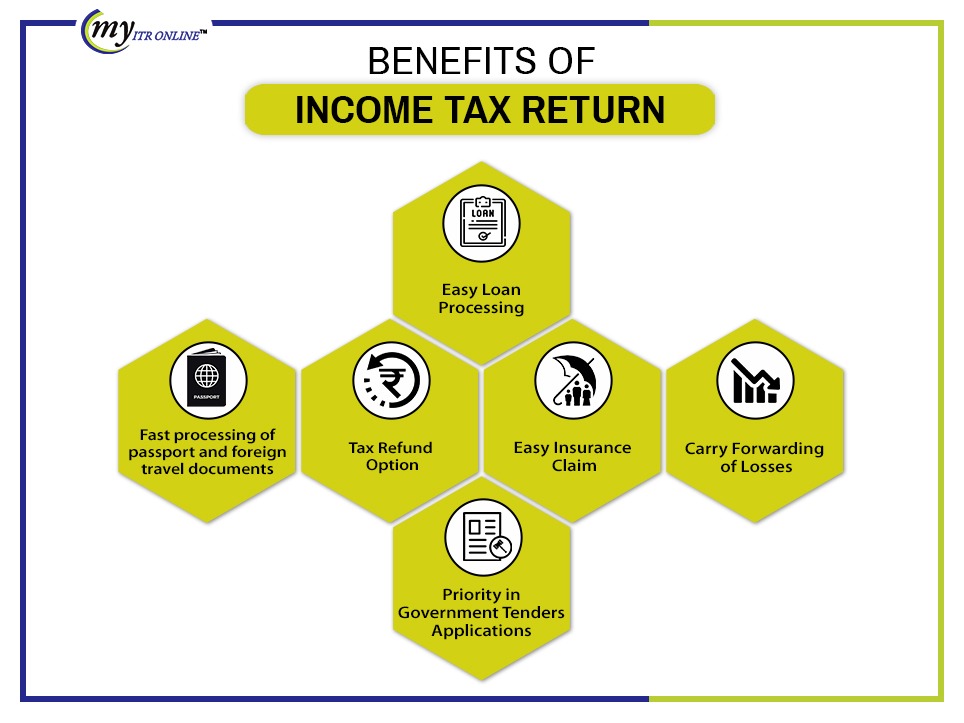

BENEFITS OF ITR FILING IN INDIA

It gives you many benefits as you make your timely IT Return. Some are:

- Easy Loan Processing

- Fast processing of passport and foreign travel documents

- Tax Refund Option

- Easy Insurance Claim

- Carry Forwarding of Losses

- Priority in Government Tenders Applications

And more.....

Be ready in advance to make your IT Return Filing on time and make sure to provide correct details to avoid Notice, Queries or Penalties. Let us know your Income Tax requirements and it’s our PROMISE to provide you the BEST Service!!!

FAQs of income Tax Registration/Return

Those registered taxpayers whose net income is below the exemption limit of Rs.2 .5 lakh, don't have to file ITR by using the ITR-1 form.

The minimum income to file ITR should be up to 2.5 lakh as per the financial year of 2021-22.

Yes. You have to file ITR even though your income is less than 5 lakh.

Yes. Salaried employees whose income is up to 5 lakh must file an income tax return with the ITR-1 form.

In case you are unable to file ITR. It can lead to penalties or imprisonment of 3 months to 2 years.

No. As per the rule of income tax, It is not compulsory to file income tax returns for government employees If their income is less than the taxable limit.

You can download ITR forms from the website of Income Tax.

You can improve your omission or mistakes made while filing the tax returns by fling the revised income tax return with proper details.

The last date for filing revised tax returns will be the assessment year of 2021-22 and 31st of March.

All the individuals who have unknowingly made mistakes when filing their income tax returns can file revised tax returns to correct those omissions with the proper details.

Our Customers Admire What We Do

I have been dealing with Myitronline and Gopal Varshney for over a decade now. The firm is highly professional, prompt, efficient and courteous. Its been a pleasure dealing with Gopal and I would highly recommend his services. Keep up the great work !!See More Testimonials

Thanks guys!.