Annual ROC Filing Compliances

Annual ROC Compliances are the detailed reporting of business procedures that every registered business unit operating in India should submit within deadline. It’s a major task for the eligible commercial entity. To make it easy for you, we’ve our reliable and affordable Annual ROC Compliances Package. It’s a guaranteed timely service to keep you secured and legally valid in conducting your business activities. Go through its details and know how it works THE BEST.

Annual ROC Compliances in India – An Overview

Companies and LLPs that are running in India with registration issued under the regulation of Companies Act, 2013 and Limited Liability Partnership Act, 2008, are to compulsorily follow a set of annual submission/declaration filing procedure with ROC (Registrar of Companies) in prescribed deadline, failing the obligation may lead to penal charges as per the rule put in place in India. Apart from that, companies and LLPs are to submit their IT Return on time irrespective of any income, profit or loss faced by the entity. Registrar of Companies (ROC) is the regulatory body working under Ministry of Corporate Affairs (MCA) that issues Registration/Incorporation Certificate to Indian Companies and LLPs, grants their closure and looks after their administrative processes. ROC is responsible to record the following documents from the registered Companies, LLPs and give approval or take necessary actions, wherever required:

- Details of Directors, Financial Statements, Board Reports, Annual Return, Company Resolution (every kind, whatever taken), etc. that are finalized by the entity in Board Meeting held as per schedule

- ROC should accept the submission of Company Resolution (as per Section 117 of Companies Act, 2013), Annual Account (as per Section 129(3), 137 of The Companies Act, 2013 read with Rule 12 of the Company (Accounts) Rules, 2014) and Annual Return (as per Section 92 of The Companies Act, 2013 read with Rule 11 of the Companies (Management and Administration) Rules, 2014) within 30 (for Company Resolution and Annual Account submission) and 60 days respectively of the conclusion made by the Board.

- ROC should check whether the Financial Statements provided by the entity are properly approved by the Shareholders and signed by at least the authorized Chairperson as per Section 134 of the Companies Act, 2013 in the Meeting.

Registered Companies of India (depending on their types) should follow the ROC guidelines to submit these mandatory annual ROC Forms added with fees, wherever required, to be filed within given deadline:

|

ROC Filing Form Name |

Purpose |

Due Date of Document Finalization |

Due Date of ROC Form Filing |

Penalty |

|

DIR-3 KYC |

Director’s KYC Declaration |

Before Sept 30 of an AY |

Deactivation of DIN that can be reactivated with late fee INR 5,000 | |

|

ADT-1 |

Auditor Appointment |

15 days from the date of conclusion of Annual General Meeting (AGM) |

Penalty in money | |

|

AOC-4 and AOC-4 CFS |

Declaration of Annual Accounts |

30 days from the date of conclusion of AGM. |

By Oct 30 of an AY For One Person Company, within 180 days of closure of the FY |

Heavy monetary penalty of INR 1000 p.m up to INR 10 lakh. |

|

MGT-7 |

Annual Returns |

60 days from the conclusion of AGM |

By Nov 29 of a AY |

Penalty of INR 100 per day |

|

MGT-14 |

Resolution with MCA regarding Board Report and Annual Accounts |

30 days from the dated of conclusion of Board Meeting |

Monetary Penalty | |

|

Form 11 |

Annual Return of LLPs |

60 days from the closure of the FY |

May 30 of an AY |

Penalty of INR 100 per day |

|

Form 8 |

Account Statement of LLPs |

Oct 30 of AY |

Penalty of INR 100 per day | |

|

MSME Form 1 |

Half-Yearly Return with the Registrar to declare the outstanding payments to Micro and Small Business Entity |

By Oct 31 (for period from Apr to Sept) By Apr 30 (for period from Oct to Mar) |

Heavy monetary penalty/Imprisonment |

Note: Based on Company Type, an entity has to file other ROC Forms, wherever required. We’ll be providing suitable consultation on that to you.

Benefits Of Roc Filing Compliance

- Helps to remain organised, aware and updated about the Company’s administrative, legal and financial position.

- Proof of existence of Companies/LLPs when their annual reports are regularly submitted correctly in ROC’s official records.

- Staying secured from penalty, for non-filing ROC on time can place a Company/LLP in legal complications leading to severe penalty.

Required Documentation Of Mandatory Roc Filing Compliance

For DIR-3 KYC

- Director’s Details, such as, Nationality and Citizenship details, like gender, date of birth, etc., PAN Number, Voter ID, Passport (mandatory if a foreign national is holding a DIN), Driving License, Aadhaar Card, Director’s communication address, mobile and Email ID

- Applicant’s digital signature (DSC)

- Applicant’s declaration letter duly attested by practising authority

Note:Attestation required on the documents to be provided as mentioned above by Practising Professionals, such as, CA, CS, Cost Accountant, Foreign Approval Office, etc.

For ADT-1

- Auditor’s Details, such as, Name of auditor/auditor’s firm, PAN Number of auditor/auditor’s firm, Registration Number of auditor’s firm, Auditor’s Appointment Terms and Conditions, Auditor’s communication address and Email ID, Date of Annual General Meeting (AGM), etc.

- Company’s Board Resolution copy

- Auditor’s Appointment Letter by the Company

- Written consent of auditor and certificate of eligibility of the auditor who is appointed by the Company

For AOC-4

- Company Details, such as, CIN (Corporate Identity Number) Number, Appointed Auditor’s Details, Date of Board of Directors where Financial Statements and Boards’ Reports are finalized, Date of AGM

- All Income Records, such as, Balance Sheet with Notes, Profit and Loss Statements with Notes, Cash Flow Statement, Statement of Change in Equity, etc.

- Copy of Financial Statements duly authenticated as per section 134 (including Board’s report, auditors’ report and other documents)

- Statement of Subsidiaries as per Section 129 – Form AOC-1

- Statement of the Facts and Reasons for not implementing the Financial Statements in the Annual General Meeting (AGM)

- Statement of the Facts and Reasons for not holding the AGM

- Approval letter of Extension of Financial Year or AGM

- Supplementary or Test Audit Report u/s 143

- Company CSR policy as per Sub-Section (4) of Section 135

- Details of other entity(s)

- Details of salient features and justification for entering into Contracts/Arrangements/Transactions with related parties as per Sub-Section (1) of Section 188 – Form AOC-2

- Details of Comments of CAG of India

- Secretarial Audit Report

- Directors’ report as per Sub-Section (3) of Section 134

- Details of remaining CSR activities

- Optional attachment(s), if any

Note: The data presented in AOC-4 should be approved by Director, Manager, CFO and CEO and should include their declaration. A Practicing Chartered Accountant and Company Secretary should also give a declaration of authenticity of the data presented in AOC-4

For MGT-7

- Company Details, such as, Company PAN, Information of Business Activities, Details of Shareholding, Subsidiary, Joint Venture and Associate Company, Number of Members, Remuneration of Directors and Key Managerial Personnel, Promoters and Debentures, Indebtedness, Penalties/Punishment/Compounding of Sentence

- Attachments, including, List of Shareholders, Debenture Holders, Approval Letter for Extension of AGM, Copy of MGT-8, Optional Attachment(s), if any

For MGT-14

- CIN (Corporate Identification Number)

- Company Details, such as, Name, Address of the Office, Contact details, like, Email, etc.

- Details of Resolution to declare, such as, Copy of Agreement/Resolution passed, Dispatch Date, Passing Date, Number of Resolutions, etc.

- Any changes in Articles or Changes to be in effect in the Company that is reflected in the resolution

- Explanatory Statement with all the details of Resolution(s), including the purpose, subject matter and the authority under which the resolution is being passed

- Details of such resolution, in case any Company winds up

For Form 11

- Details of LLP and/or Company in which partners/designated partners (DP) are directors/partners (mandatory, if any partner/designated partner is a partner of LLP or director in any other company)

- Any other relevant information as optional attachment

For Form 8

- Disclosure under Micro, Small and Medium Enterprises Development Act, 2006 (mandatory)

- Audited Financial Statement (if applicable)

- Statement of Contingent Liability (if contingent liability exists)

- Any additional documents (if required)

For MSME Form-1

- Supplier details, such as, Name of supplier, PAN of supplier

- Due amount of supplies of goods/services

- Date from which the amount is due

- Reason of delay in payment of the due amount

Our Package Is Offering You:

Our ROC Packages differ in Package Value based on the Company Turnover and Type of ROC Annual Filing Type chosen. Based on that, we’ll be providing you the following services:

- Consultation

- Commencement of Business Certificate (If Requested)

- DIN Registration (If Requested)

- Documents Preparation (wherever applicable), Crosschecking, Verification, Attestation and Authentication (As per requirement)

- Application Drafting and Processing

- Annual ROC Form Filing

- ITR Filing (If Requested)

- Form Submission Update

- Fees Processing

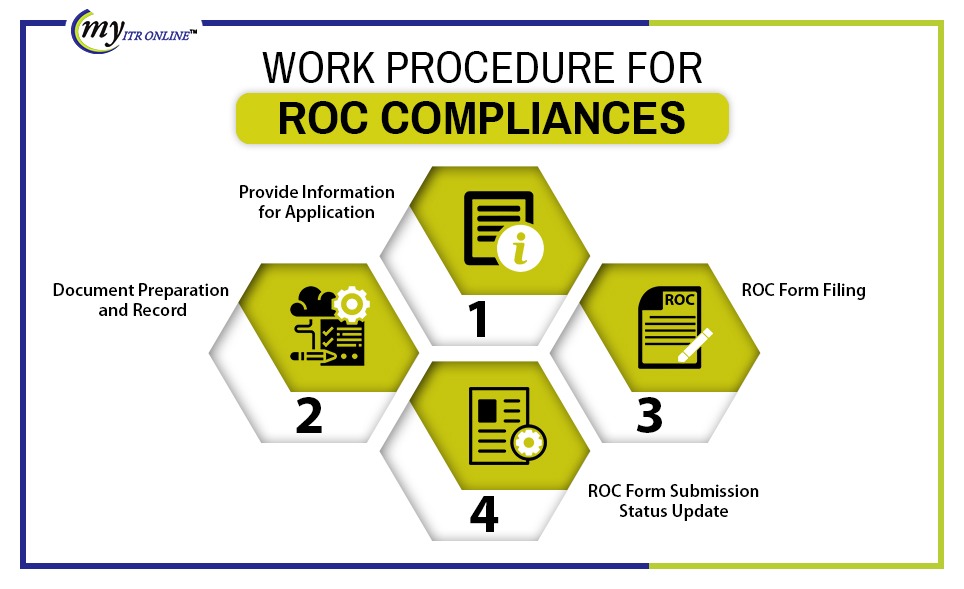

Procedure Of ROC Filing

Please note that, we’ll be including the Incorporation Certificate as per demand and thereafter be coming to our service of Annual ROC Filing (Based on Company Type) as mentioned below:

Step-1) Provide Information of Application

Based on the ROC Filing Package you choose, you’ve to provide us the necessary information needed for ROC Annual Filing. Please note that, we need these information in advance giving us sufficient time for checking, drafting and finalizing all the documents to be taken for processing your ROC Form before the due date to avoid any kind of penalty. In case of any insufficient or faulty information leading to delay in the processing of documents will not come under our liabilities for any reason.

Step-2) Document Preparation and Record

We’ll be communicating with you regarding the documents that are needed to be prepared giving our expert opinions, wherever required. As per your demand, we’ll be preparing the records/documents based on the information/data provided by you, such as, Financial Statements, Annual Report, Director’s Report, Board Resolution, etc. You’ll be given complete update on each document that is prepared seeking your assistance/feedback as required.

Step-3) ROC Form Filing

Once the documents, information and records are finalized, crosschecked and ready, we’ll begin filing your Annual ROC Form, as per the chosen package. Please note that, as said earlier, we wont be liable of any penalty that is charged on the ground of late filing that has occurred because of any kind of delayed communication from your side.

Step-4) ROC Form Submission Status Update

We’ll be letting you know about the status of ROC Filing. Also, we’ll be providing you all the documents that are prepared from our side.

Wish you All the Best and Let us Serve you Again!

FAQs of ROC Compliance

As per the ROC, Companies are required to inform the registrar of the company about every change that will be made such as the name of the company, the objective of the company, or the article of association. Moreover, the company also needs to fill out the various forms with ROC.

Yes. It is mandatory to fill out the ROC forms so that the government can know about the company’s performance during the financial year.

Every existing company must file out the ROC forms under sections 129 and 137 of the companies act, 2013.

There are two types of ROC compliances to be filed by the companies which are following- First is the annual compliance filing which is required to fill out once a year by all the incorporated companies act 2013. The second is another compliance filing which is required to be filled out from time to time.

The due date for filing Form 66, Form 23AC, and Form 23ACA is the last 30 days from the date or (AGM) annual general meeting. Moreover, form 20B must be filed within 60 days from the AGM’s date.

As per the section If a Pvt. Ltd. company fails to file the annual returns on time then The company and each officer will be punished with a fine under section 162 of the companies act of 1956.

If the company does not file ROC then the directors along with the officers will be liable to pay the penalty of rs.50,000.

The essential documents are followed for filing the ROC every year. Balance Sheet Annual Return Profit and Loss Account Cost Audit Report

No. Tax deducted at the source is not applicable for the ROC.

Yes. Filing Due Date of ROC for FY 2020-21 is extended to 15th March 2022 for AOC-4 and 31st of March 2022 for MGT-7 forms.

The MGT-7 form is utilized for filing the annual returns of the company. And AOC-4 is used for filing the financial statements of the company as well as the directions report and annual returns.

Our Customers Admire What We Do

I have been dealing with Myitronline and Gopal Varshney for over a decade now. The firm is highly professional, prompt, efficient and courteous. Its been a pleasure dealing with Gopal and I would highly recommend his services. Keep up the great work !!See More Testimonials

Thanks guys!.