EPF Registration For Employers

EPF Registration is an employee’s after-retirement provision that an eligible employer should be registered to fulfil the contribution. Our EPF Package gives you convenient, affordable and 100% reliable Registration Solution to its customers. So, when you’re an eligible employer, choose this package to let us work for you. This advantageous registration is a major tool to help you obtain employee trust, build your organizational reputation and receive prosperous job seekers. Go through its details and know how it works THE BEST.

EPF Registration for Employers in India – An Overview

EPF Registration, the abridged form of ‘Employee Provident Fund’ Registration is a legal process allowed by Government of India, to financially secure the salaried employees of organized sector during retirement/in case of any major financial necessities/for the dependents if the employee dies. This income is earned through the fund that is contributed by both employer and employee in the service time. It is the most convenient, secured and easily accessible mode of retirement benefit available in our country as regulated by Employees Provident Fund Organization of India with these major guidelines:

- Any establishment in India with 20 or more people working in it (in certain circumstances as per Government Policy, business sectors with employees less than this number can voluntarily register for the scheme in Regional Provident Fund Office)

- EPF Registration for the eligible business unit should be done within 1 month of hiring the mentioned number of employees, violation to which can lead to legal obligations.

- EPF scheme is a mutual contribution based fund where both employer and employee have to contribute in a specific monthly rate calculated over employee’s salary.

- Employees with wages up to INR 15,000 working in an organized sector recognized for EPF, should be enrolled in this scheme. (Those employees with salary more than this amount during the time of joining need not be its member, but there is not restriction applicable for them in case they avail the facility with the consent of their employer and Assistant PF Commissioner)

- The facility is available for public, private, and government employees, if they delayed in registration then the result might be in penalties.

Benefits of Employer's EPF Registration

- Ensures financial security during retirement/illness/death of the employee and secures his/her dependent family members.

- Employee Provident Fund maintained with the contribution by both Employee and Employer, includes pension cover to give after-retirement financial security to the employee.

- The PF is linked with Life Insurance Scheme that is applicable for only PF Account Holder.

- The fund permits loan/partial sum withdrawal on emergency needs to the PF Account Holders, such as, illness, disability, unexpected expenses, like any accident, shifting, etc.

- The fund helps in securing the long term goals, such as, home purchase, child’s marriage, higher education expenses, etc.

- The fund can be transferable and uniformly maintained and can be carried forward with the change in employment.

- For some business sectors, Government Contribution in EPF Fund is sanctioned with tax benefits.

- Employee’s PF contribution is eligible for tax exemption u/s 80C of IT Act. Income from EPF is exempted from tax.

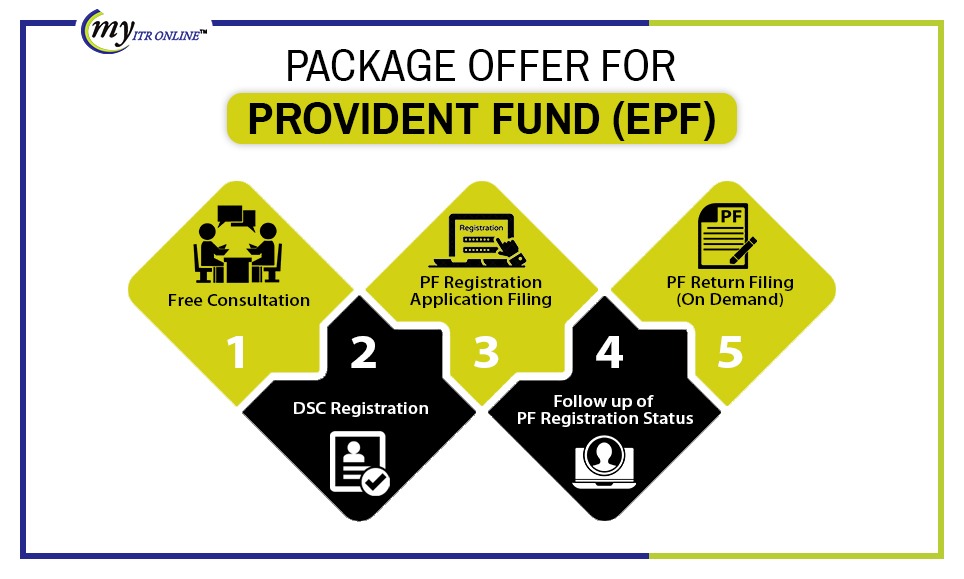

Our Package is offering You:

Package Price differs based on the Employee Capacity of the Business Unit.

- Free Consultation

- DSC Registration

- PF Registration Application Filing

- Follow up of PF Registration Status

- PF Return Filing (On Demand)

Documentation for Employer's EPF Registration

- Applicant Name (As given in Income Tax Department)

Note: Applicant can be a registered business unit, such as, Proprietorship, Partnership Firm/LLP/Company, Society/Trust, etc. In case of Proprietorship, Name of Proprietor is needed.

- List of Partners/Directors (whatever applicable) and their communication details, such as, telephone number, address, etc. If Proprietorship, Proprietor’s communication details.

- For Partnership Firms/LLP/Company/Society/Trust, Details and ID Proof of the Managing Members of the relevant Unit. In case of Proprietorship, Proprietor’s ID Proof, such as, Aadhaar Card/Voter ID Card/Passport, etc.

- A copy of PAN Card of the Applying Business Unit

- Certificate of Incorporation, if the business unit is a LLP/Company.

Certificate of Registration and Partnership Deed, in case of a Partnership Firm. - In case of Society/Trust, MOA and Bye-Laws of the same.

- Business Address proof

- If you own the Registered Office, provide property papers.

- If the Registered Office is rented/leases, legal agreement of the same.

- Copy of First Sales and Purchase Bill (raw materials, machinery, etc.)

- Bank Details of the Business Unit with proof

- Cancelled Cheque with a preprinted name and a/c no.

- GST Registration Certificate (if the Unit is GST Registered)

- Employee details, such as, Employee capacity (monthly record), Employee Name, DOB, Essential Personal details, Date of Joining, Register of Salary/Wages, etc.

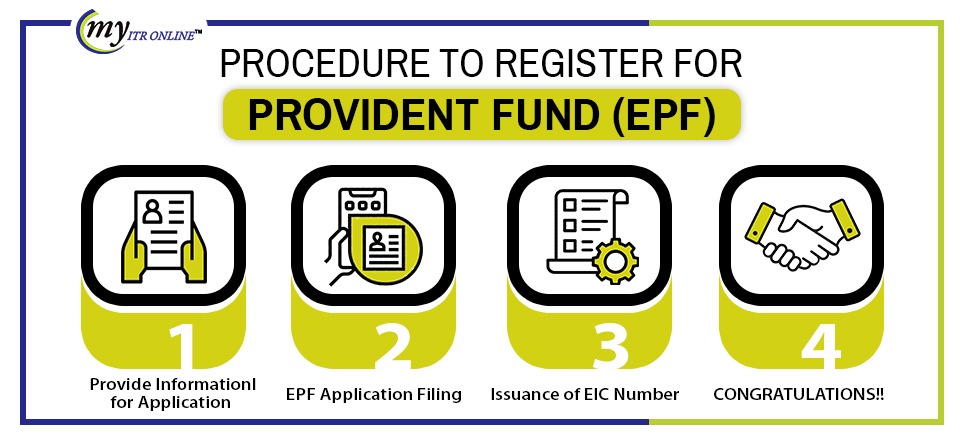

Procedure for Employer's EPF Registration

Step-1) Provide Information for Application

We’ll be giving you consultation on the documents and information required for your EPF Registration based on your Business Unit. It will be helping you to arrange the documents correctly and we’ll be crosschecking them once you provide us the same. Once satisfied, we’ll be proceeding in filing your EPF Application.

Step-2) EPF Application Filing

Once, we’re satisfied with your information and documents, we’ll be proceeding to file your EPF Registration Application. Here, we’ll be needing your DSC (Digital Signature) for registration. We’ll be filling up the form called Proforma for Coverage for your EPF Registration. It’ll be thoroughly crosschecked by us and updated to you. It is mandatory for you, as a Business Unit, to submit Form-5A and Annexture-1.

Note: Once your application is filed online, you’ll be informed about the allotment of your code number, and login details to access the EPO Official Portal. This login details will be used to download and send your Code Allotment Letter to EPFO Office.

Step-3) Issuance of EIC Number

Once we obtain the Allotment Letter in your Name from the EPF Official Portal, it will be sent to EPFO Office for detailed verification from the concerned Department. When the Department is satisfied, you’ll be issued with EIC Number.

Step-4) CONGRATULATIONS!!

Now, you’re legally eligible to provide Employee Provident Fund facilities. Once registered with EPFO, you’ve to follow these compulsory procedures:

- File monthly return by uploading ECR sheet usually by 15th of the succeeding month. ECR Sheet can be downloaded from the Official EPF Website.

- Regular contribution in EP Fund that is deducted as per the guidelines should be included in your Return.

FAQ for EPF

PF or provident fund is another short term for EPF. EPF stands for the employee’s provident fund that is deducted from the salary of an employee for the services given by an employee in an organization. An employee can withdraw this amount after retirement or can avail of a loan also.

PF or Provident Fund is divided into the 4 categories which are as follows- Statutory Provident Fund. Recognized Provident Fund. Unrecognized Provident Fund. Public Provident Fund.

An employee must be in the service for a minimum of 60 years to withdraw his/her PF amount. He/she can also withdraw PF money one year before retirement, but only 90% of the amount will be permitted to withdraw.

If an individual’s salary is up to rs. 15,000 per month then It is mandatory for him or her to have an EPF (employee’s provident fund) account.

If any organization has a minimum of 20 employees, is liable to open EPF accounts for its employees.

When you resign or retire from the organization, You can withdraw your whole provident fund along with a condition that you must have spent at least 2 months unemployed.

No. You can not join EPF directly. As per the EPF or MF act, 1952, you must be in the service of an organization to be liable for the EPF.

No. There are no predefined restrictions to being a member of EPF. Anyone can be a member of EPF. In a specific case, if he/she has crossed the age of 58 years then they are not liable to be a member of EPF

If you do not get membership in the provident fund, you should ask first your employer. If he/she still denies providing you with an EPF membership, then You can reach out to your regional provident fund commissioner.

No. It is not possible for an eligible employee to opt out of EPF.

Our Customers Admire What We Do

I have been dealing with Myitronline and Gopal Varshney for over a decade now. The firm is highly professional, prompt, efficient and courteous. Its been a pleasure dealing with Gopal and I would highly recommend his services. Keep up the great work !!See More Testimonials

Thanks guys!.