About Myitronline Rent receipt

Myitronline is an easy-to-use Rent receipt generator online tool that helps you to produce rent receipts for the rent you paid to the landlord during a financial year. Our online tool generated the receipt as per the specified format by the Income Tax Authorities. You can take a printout of these receipts and submit it to the Finance Department to get an HRA house rental allowance exemption based on the genuine rent paid by you.

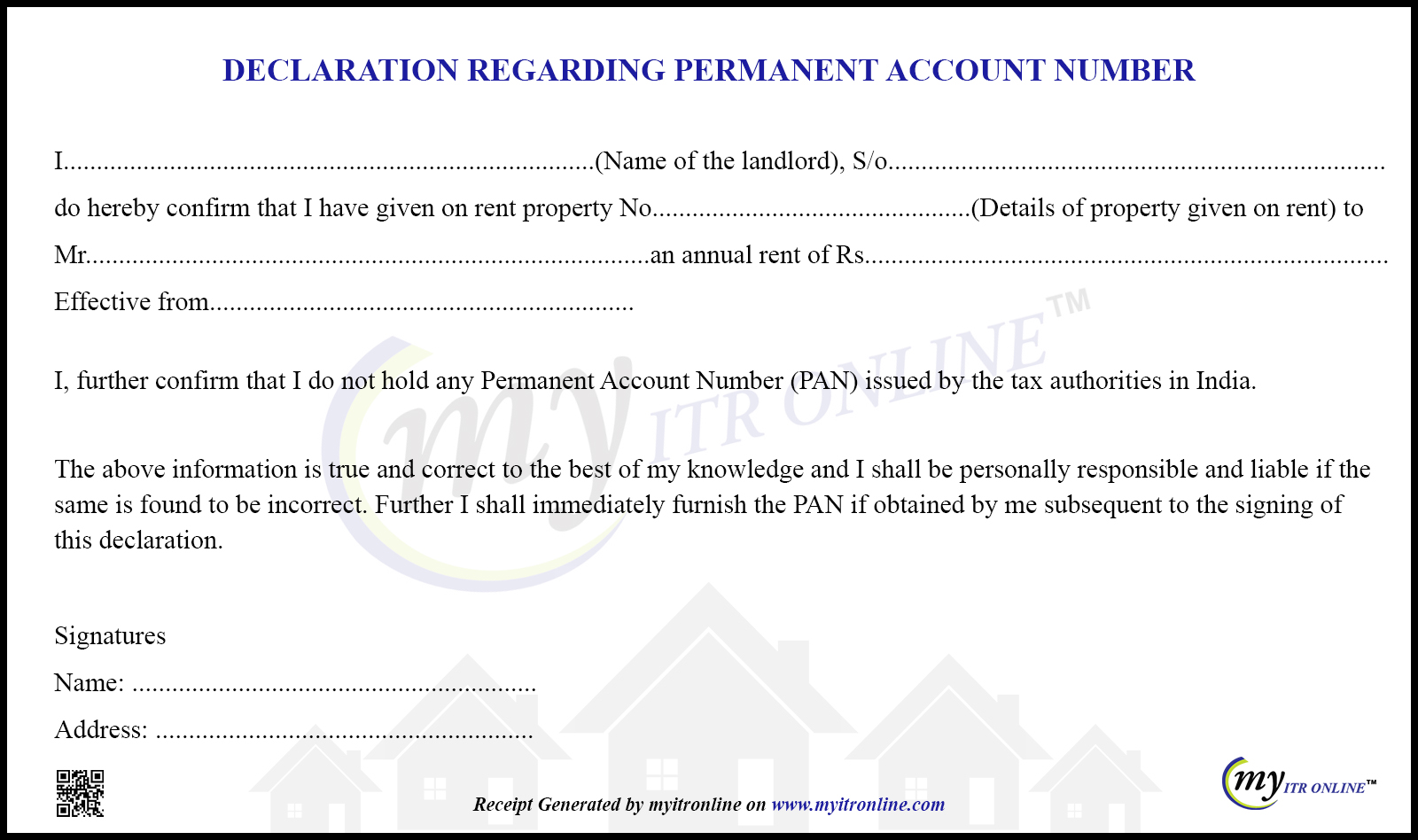

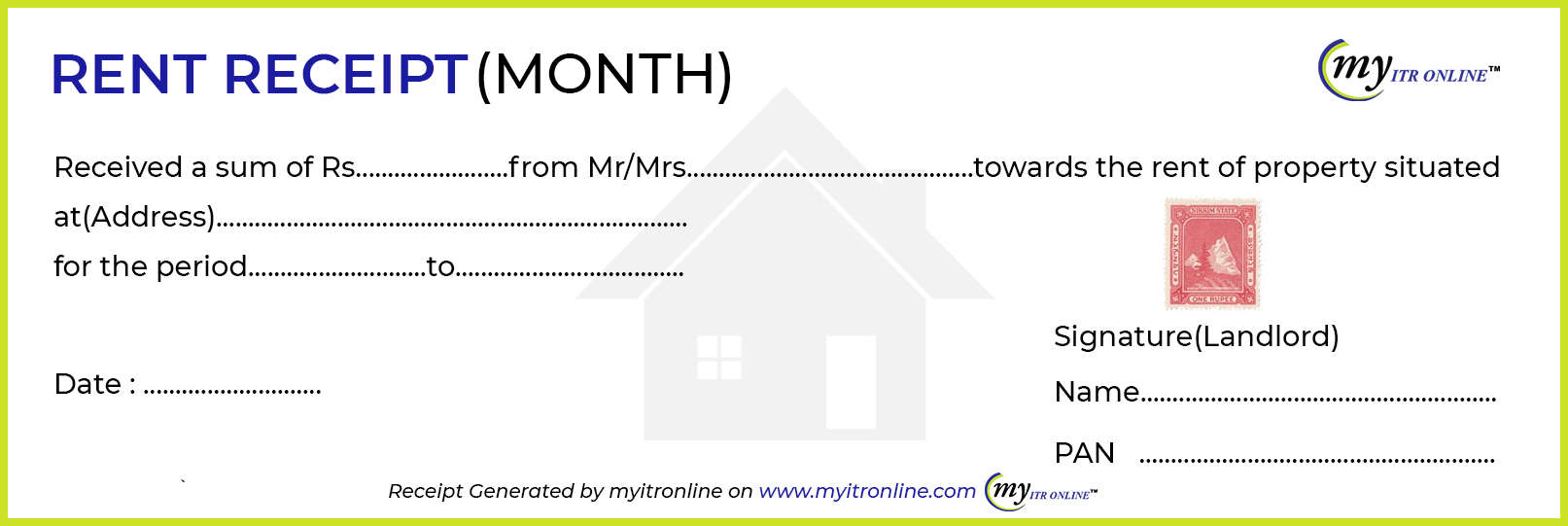

Rent Receipt Template Format Sample

Generate and Print Rent Receipts Pre Filled Templates at Myitronline | Create a Free Rent Receipts

Myitronline offers the Option to generate printable rent receipts

online - Monthly, Quarterly, Half-Yearly, and Yearly.

In order to claim HRA

exemptions, it is compulsory to submit Rent Receipts to the employer. Following are

the steps.

- Generate rent receipt by filling in the valid documentary details.

- Print the receipt.

- Get a stamp on the receipt & sign of the landlord.

- Submit Rent Receipts to your employer.

Why do we need rent receipts in HRA?

A rent receipt is a crucial document that is used as proof of the rent paid to the landlord. It is a tool for tax saving and so should be collected and kept safely. Salaried employees must fill out rent receipts to declare their House Rent Allowance (HRA). if You want to claim income tax advantages on house rent allowance then you must provide the proof of rent paid to the employer.

How to generate rent receipts online at Myitronline.com?

In order to claim HRA exemptions, it is compulsory to submit Rent

Receipts to the employer. Following are the steps.

This process can be done in a

few steps that are given below-

- First You must put Your Name and Email Address.

- Then Enter the monthly rent amount paid and house address.

- Fill out details about yourself and the landlord like (Owner's Name and House Owner's PAN number).

- Make a Selection of the Period for which you want to generate a rent receipt (Monthly, Quarterly, Annually)

- Press on the Generate Rent Receipt button, and Myitronline will deliver an email of your Rent Receipt.

What are the details required in the rent receipt generate?

The following are the details that are required in the rent receipt:

- Resident Name (If you are the lodger, fill in your name and Personal Email Address)

- Amount of monthly rent.

- Enter your House address and Proceed to the next button.

- House owner Name.

- House Owner's PAN no (optional).

- Date of Payment.

- Rental Period.

- Signature of Landlord or Manager.