What is an IFSC Code?

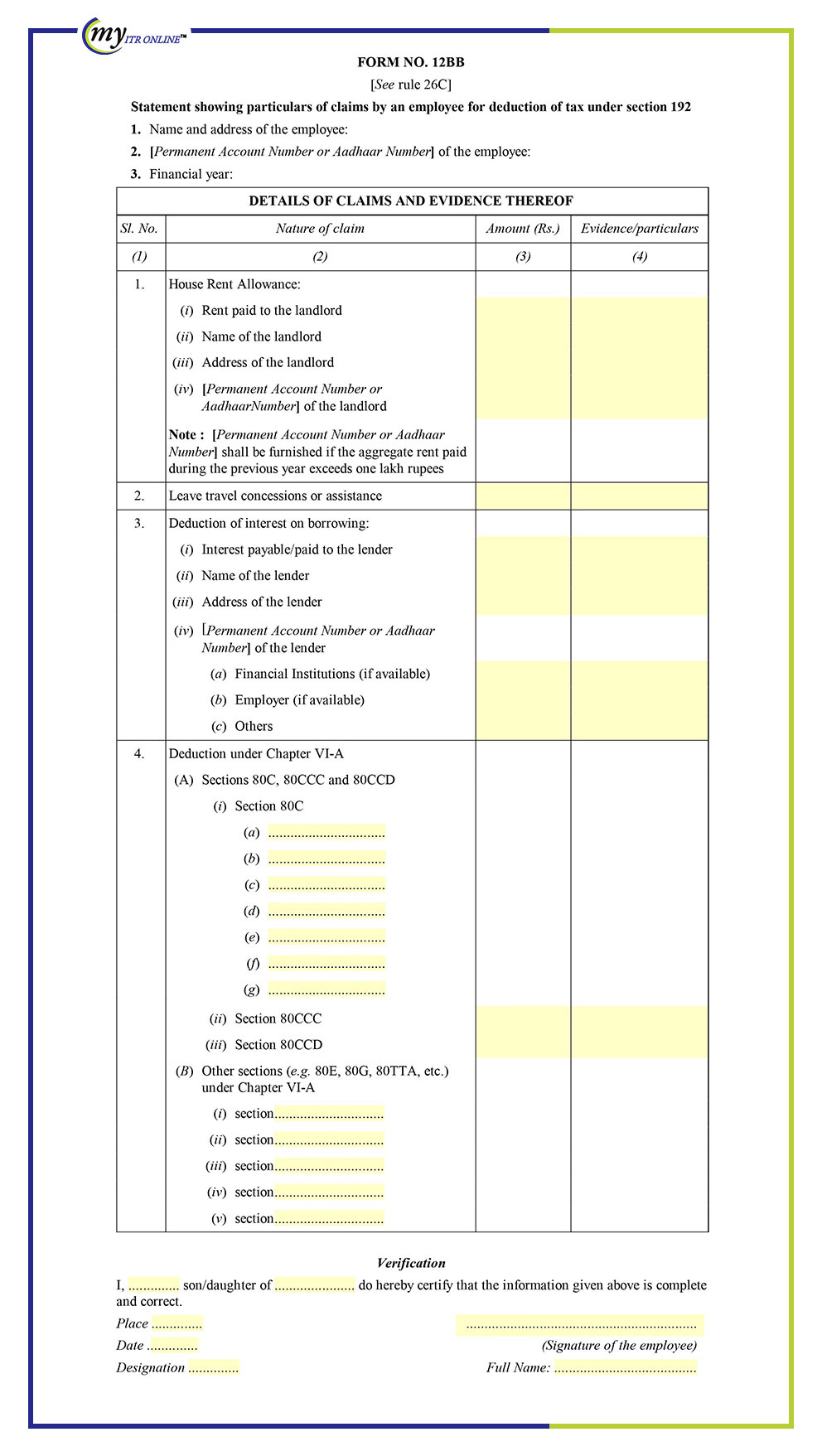

Central Board of Direct Taxes (CBDT) created a standardised regulation of investment declaration on 1st June 2016 with the introduction of Form 12BB. Before 2016 there was no particular format or regulation for the investment declaration. Form 12BB is claimed by an employee for diminution of tax. You have to complete the 12BB Form and submit it to your employer - not the Income Tax Department so that your employer can estimate how much tax revenue should be deducted from your monthly income. Form 12BB contains information related to tax and investment costs that you would have incurred during the current financial year.

For what purpose of Form 12BB was created?

The Revenue Department has announced the standard format of Form

12BB. An employee has to give a statement of investment and expenses made throughout

the year. He/She also must submit documentary evidence of all expenses and

investments at the end of the financial year.

At the beginning of your new job,

You have to complete a 12BB form. However, by the end of the year, you must submit

proof against tax exemptions, investments, and expenses already claimed by you on

form 12BB. From 1st June 2016, It was mandated for a salaried employee to submit the

Form 12BB to his or her employee to claim tax benefits or rebate the investments.

What is the format of Form 12BB?

The Income Tax Department has created a standard Form 12BB form for

salaried employees to claim deductions. It was altered in terms of Rule 26C of the

Income Tax Act. Form 12BB can be downloaded online in the form pf pdf or text

format, take out a print of it and send it to your employer with all required

documentary evidence.

Alternatively, you can complete Form 12BB online and send

it directly to your HR or print it, sign it and send it to your employer with the

required proof.

What information are required to be filled in Form 12BB?

An investment announcement should be made for the following tax-saving investments

The information required to report it on Form 12BB is:

Your Personal information

- Form 12BB requires employee name and current address, employee PAN number, father's name, company details, etc.

- Financial Year - The current Financial Year is by F.Y. 2022-2023

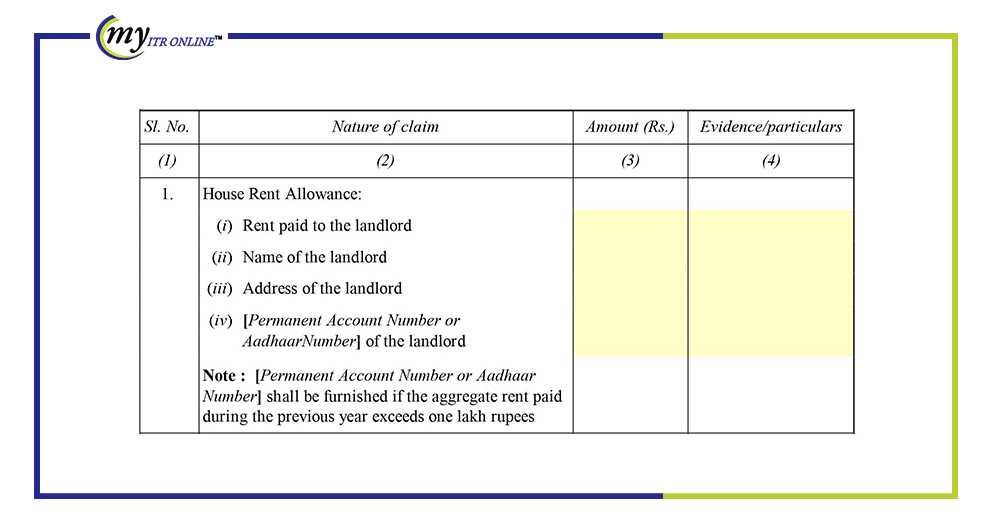

House rent allowance

- Rent payable to the landlord and the name, address and PAN / Aadhaar number of the landlord.

- Financial Year - The current Financial Year is by F.Y. 2022-2023

Click here to generate a rental receipt to find out more about how to produce a Rent Recipt.

Know more about how to claim house rent allowance.

Leave travel concessions or assistance

- Leave travel concession or leave travel allowance as per salary package

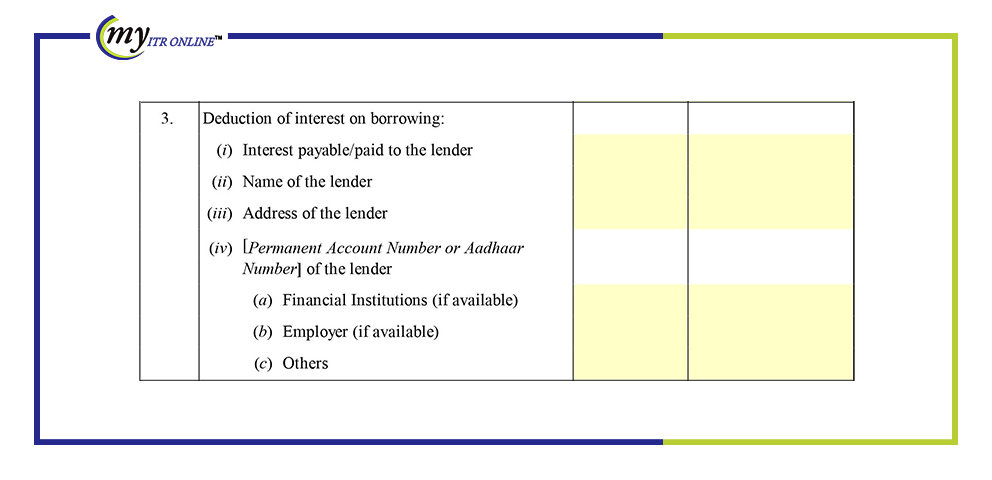

Home loan interest

- Interest payable to lender along with name, address and PAN/Aadhaar number of the lender

Know more about deduction on home loan interest.

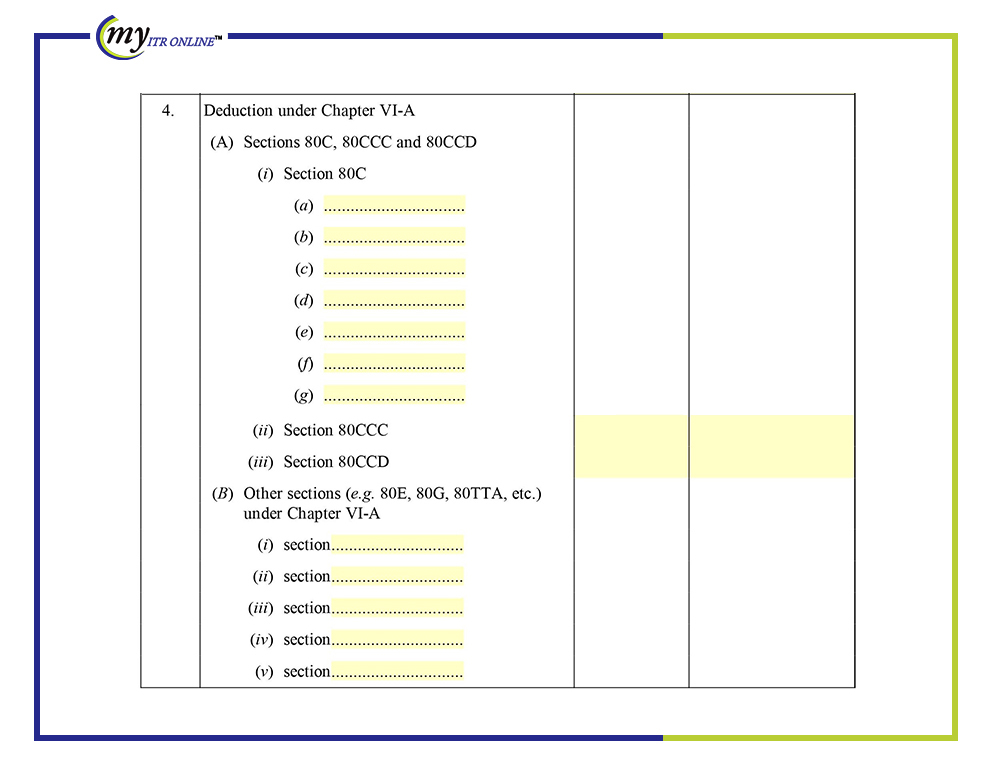

Deductions under Section 80C, 80CCC, 80CCD

- 80C: Premium to be paid for life insurance and/or investments to be made from ELSS funds, PPF, NPS, and/or children's tuition fees, etc.

- 80CCC: Premium will be paid in cash.

- 80CCD: Additional contributions made to NPS.

Know more about deduction under section 80C, 80CCC, 80CCD.

Deductions under other sections like 80E, 80G, 80TTA, etc.

- 80D: Premium to be paid for medical insurance.

- 80E: Interest to be paid on education loan.

- 80G: Donations to be made to specified organizations.

- 80TTA: Interest income earned from savings bank account.

Things need to be done before filling out the 12BB Form

Probe and analyse your CTC structure to know if LTA or HRA is attached to your package or not. The allowances can only be claimed when your employer takes them as a part of your CTC structure. You need to visit your bank or you can download your certificate of interest and loan repayment or your home loan and bank account statement. Collect all your receipts of your expenses, investments, and deductible amount done by you. For instance, LIC premium receipts, tuition fees, rent receipts, etc.

Required Information to fill in the Form 12BB

The details which are required to mention in Form 12BB are given below-

- Personal details like Identity proof, PAN number, father’s name, and address.

- HRA: House rental allowance

- Leave travel authorization or assistance

- Interest on home loan

- Small details like date and place

- Income tax deductions

Filling out the Form-12BB

Filling out Form 12BB is effortless and simpler than other forms.

Form 12BB requires a few documents and proof. Let's make it clear step by step.

The first part of the form 12bb asks for your personal details such as Full name,

address details, PAN number, and corresponding financial year details.

Interest deduction on borrowing -You can avail of the interest deduction on

your home loan for any type of purchase, repair, or building establishment.

Deduction home loans are permitted under section 24. You need to submit these

documentary details. Enter the relevant paid interest to the lender for the

financial year. Secondly, write the name of the lender carefully along with his

address, and lastly, mention the PAN details of the lender.

House Rent Allowance -You can avail of the tax deduction under the house rent

allowance according to the mentioned CTC by the company. In this part, you must fill

in these details. You have to mention the name of the landlord in the first column.

Make the entry of rent which is actually paid. The rent receipt should be submitted

to claim the house rent allowance. Certain organizations may ask for rental

agreements for proof also.

(LTA) Leave Travel Allowance -LTA or Leave Travel Allowance is provided “as

per the salary package” to salaried employees. LTA can not be claimed in a country

outside travel. To claim a tax deduction on (LTA) Leave Travel Allowance, you must

submit all the documents related to your travel expenses as proof. The individual

should possess travel bills like invoices, airline tickets or rail tickets, travel

agencies, etc. To be noted, the total expenses that you want to claim and all those

related documents are to be mentioned in Form 12bb. You can only avail of LTA 2

times in the 4 years of gap.

How to fill Form 12BB?

Completing tax returns can be a nightmare for many of us. However, completing Form

12BB is not as scary as it may seem. So, let's get down to it!

Just follow these

instructions to understand and complete the complete form for maximum tax return.

Now let's talk about each of them in detail:

I. Personal Details :

This is the first section of Form 12BB, you need to mention your :

- Full Name

- Address

- Permanent Account Number

- Financial year (Current Financial Year is F.Y. 2017-18)

II. HRA(House Rent Allowance) :

For claiming HRA tax exemption, you need to submit the following details to your employer -

- Amount of Rent paid

- Name of your landlord

- Address of your landlord

- PAN No of your landlord in case the total amount of rent paid during the year exceeds Rs.1 lakh.

In Addition, you also need to submit the proof for claiming HRA tax exemption .

1. Evidence/Proof for claiming House Rent Allowance tax exemption:

The proof for claiming HRA tax exemption is the monthly rent receipts. In many organizations, employers also asks for the rent agreement for allowing HRA tax exemption.

2. Amount of tax saving on House Rent Allowance(HRA):

This is the best tax saving avenue.Calculate your HRA tax exemption with our free HRA exemption calculator tool.

Read our complete guide on rent receipts to know in detail how you can claim HRA tax exemption to save maximum tax

3. Things to remember when claiming HRA tax exemption :

- You can claim HRA tax exemption only when HRA is a part of your CTC.

- In case, HRA is not a part of your CTC and you are living in a rented house you can claim tax benefit under section 80GG.

- A rent receipt is required only when your monthly rent exceeds Rs. 3,000.

- You can’t claim HRA if you are living in your own house.

- If you are paying rent to your parents, then ask them to show it as their income at the time of filing their Income Tax Return.

- Never submit fake rent receipts, this might land you in big trouble with the income tax authorities.

- Even if your employer does not ask for a rent agreement, it is advisable to have a formal rent agreement printed on Rs. 500 stamp paper or as per the rate prevailing in your state for records.

III. LTA(Leave Travel Concession/Allowance):

This allowance is one and the only allowance that helps save tax only when you take a holiday.

1. Evidence/Proof for claiming LTA tax exemption:

To claim LTA, employees need to submit travel bills like boarding passes, flight tickets, invoice of a travel agent, boarding pass, etc. to the employer.

2. Amount of tax saving on LTA :

This tax exemption is allowed only on actual travel costs to the extent specified in CTC. The fare is exempt as per the following conditions:

| Travel Mode | Exempt Amount |

|---|---|

| Air | Airfare of economy class in the National Carrier by the shortest route or the amount spent, whichever is less |

| Rail | Air-conditioned first-class rail fare by the shortest route or the amount spent, whichever is less |

| Bus | First Class or deluxe class fare by the shortest route or the amount spent, whichever is less |

| Unrecognized public transport system | Air-conditioned first-class rail fare by shortest route or the amount spent, whichever is less |

3. Things to remember when claiming LTA tax exemption :

- You can claim LTA only when it is a part of your CTC.

- You can claim LTA for yourself, your spouse, children, dependent parents, and dependent brother and sister.

- It can be claimed twice in a block of four years. The current block is 2021-2022.

- If you have claimed only 1 LTA in the previous block of 4 years, you can carry forward and utilize the 2nd LTA but have to claim it in the first year itself of the next block.

- It is allowed for domestic travels and not for international travels.

IV. Deduction of Interest on Borrowing :

Deduction of interest on borrowings on a home loan is allowed under section 24 of the income tax laws. You can claim a deduction for interest on your home loan taken for construction, reconstruction, repair, purchase, or renovation.

The information needs to be filled in the Form 12BB are:

- Interest Payable/paid to the lender during the financial year.

- Name of the lender from whom the loan is taken.

- Address of the lender.

- PAN of the lender: Financial Institutions/Employer/Others, from whomever the loan is taken.

1. Evidence/Proof for Claiming tax exemption for interest on borrowing:

Documents required to claim deduction u/s 24B on interest payment of home loan are:

- Statement / Certificate stating total EMI paid along with Interest and Principal components.

- Possession/construction completion certificate.

- Self-declaration from employees whether the house is self-occupied or let out.

2. Amount of saving on Home Loan :

a. Tax benefits on payment of interest :If you are paying interest on a home loan, then the quantum of deduction will depend on the type of house property. Let’s discuss the same in detail.

Tip: Claiming deduction on interest payment shall result in a loss under head house property. This loss can be adjusted against income from other heads in the current year subject to the limit of Rs. 2 lakh.

I. Tax benefit in case you have the self-occupied property (SOP):

The maximum interest of Rs. 2, 00, 000 is allowable in case a loan is taken for the purchase or construction of your house. Such benefit shall be reduced to Rs. 30, 000 in case a loan is taken for repair/ reconstruction. Further, construction or purchase must be completed within 5 years from the end of F.Y. in which loan is taken.

II. Tax benefits in case you have rented out(let-out) the property (LOP) :

The entire interest amount that you pay towards the loan is available as a deduction in the case of the rented property. Such amount shall be deducted from the rental income for the year.

Note : However, from 1 April 2017 onwards i.e. F.Y. 2017-18, the maximum tax exemption of Rs.200,000/- can be taken for all types of houses(let-out/self-occupied). In case, you have paid more than Rs.2,00,000 as interest on a home loan taken for construction/purchase, then the remaining amount shall be allowed to be carried forward for set-off in subsequent years.

In both cases, whether there is self-occupied property or rented property, principal amount repayment is eligible to be claimed under Sec 80C of the income tax act. A maximum of Rs. 1.5 lakh can be claimed under Sec. 80C for the principal amount. (Max. The limit of claiming all deductions under 80c is 1.5 lakh. So, plan accordingly.)

3. Things to remember when claiming Interest on Home Loan tax exemption :

- In case, you have taken a home loan jointly then you can claim the benefit of the interest deduction proportionately.

- If you have taken a home loan from a lender other than the bank i.e. your friends, relatives, or any money lender the interest payment can be claimed as a deduction under section 24. Provided you take a certificate of interest from the person to whom you had paid interest.

- Where a loan is taken from your friends, relatives, or any money lender i.e. other than banks the repayment of principal is not eligible for deduction under section 80C.

This part of the form may take more time to finish if you are claiming maximum tax benefits. If you do not have any deductions to make, you can then move on to the last section.

V. Deductions under Chapter VI-A

Chapter VI-A covers income tax deduction under various sections like 80C, 80D (Medical insurance) 80G (Donation), etc. To claim the deduction, evidence of investment made or expenditure incurred is required. You might be wondering what kind of proofs are required to submit to claim these deductions. Don’t Worry, we are here to help you.

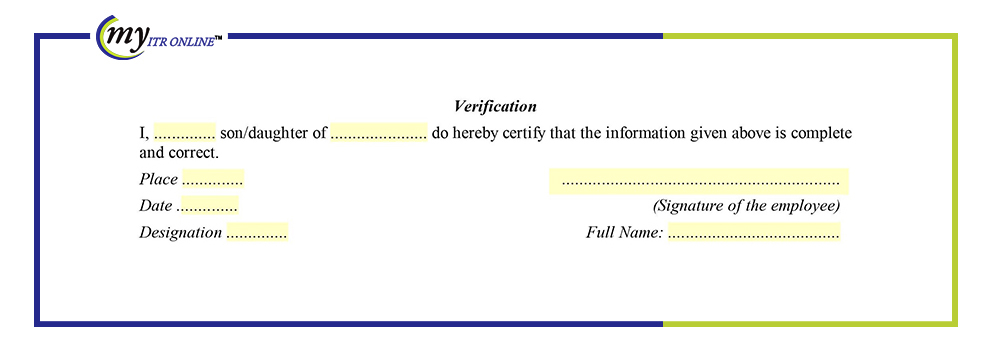

VI. Verification

The last section of Form 12BB is the “verification” of the information submitted in Form 12BB. You need to just enter your name along with the name of your father/mother and the place(a city in which you are filling the form) and the date of filing the form and then sign the form.

Done!

Easy isn’t it!

“In order to avoid tax deduction altogether, you’ll have to have no tax liability this year “