What is an IFSC Code?

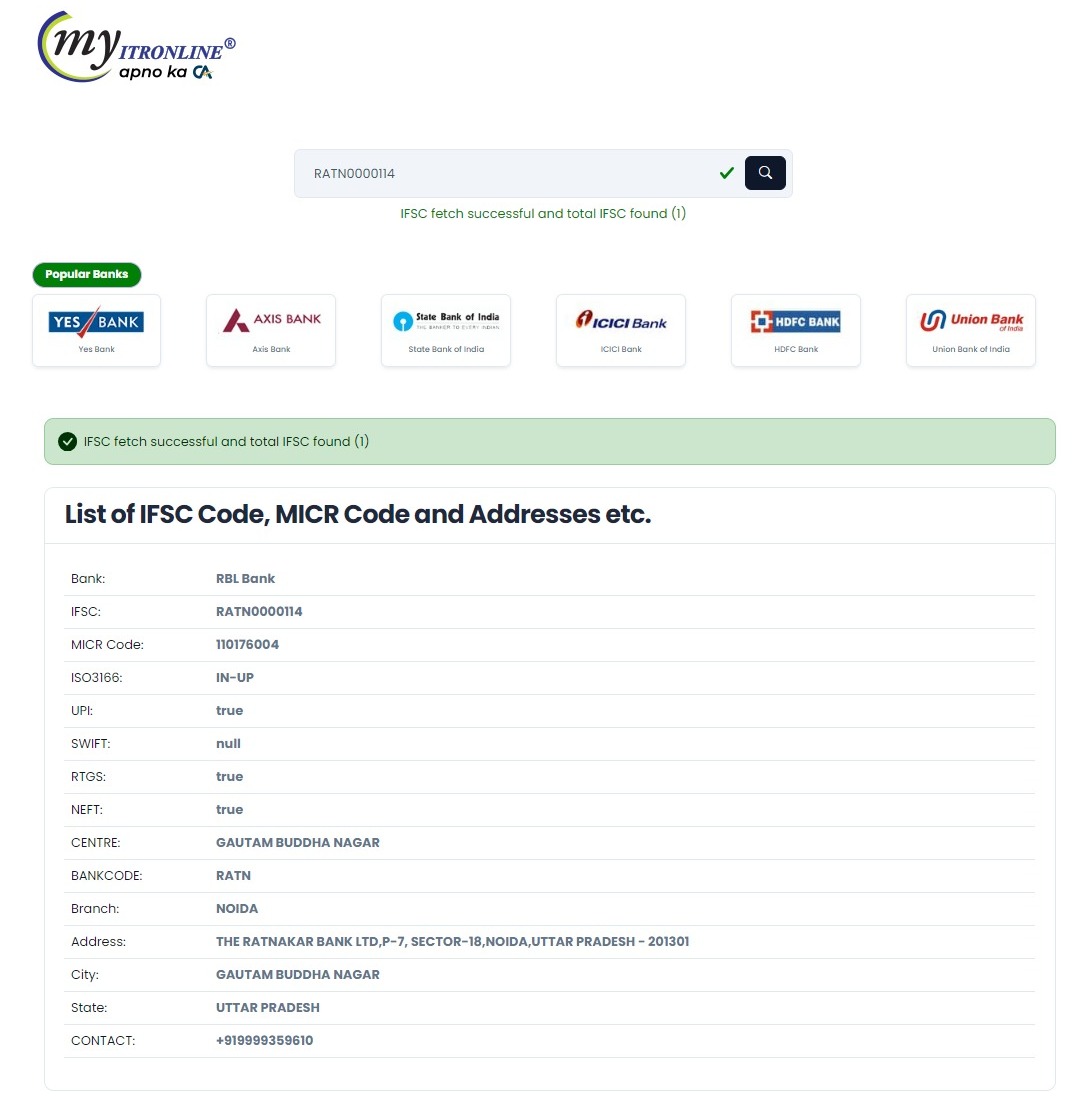

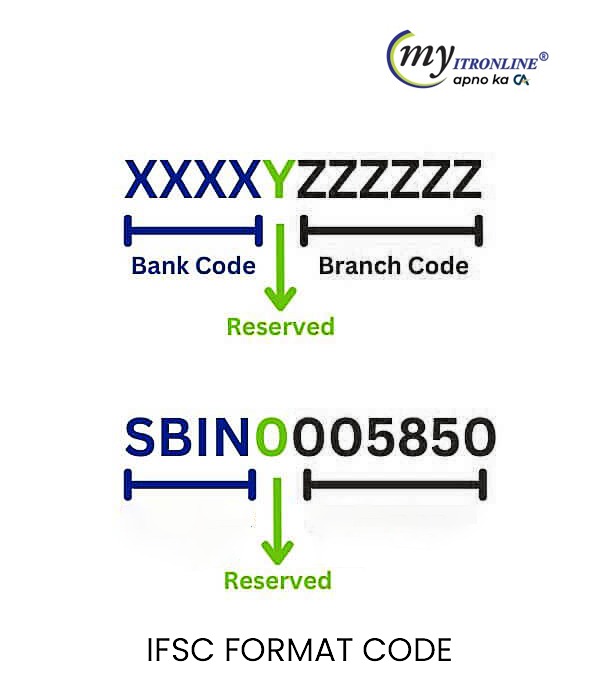

The Indian Financial System Code (IFSC) is an eleven-digit alphanumeric code assigned by the Reserve Bank of India (RBI) to every bank branch. This code is essential for various types of electronic fund transfers, including NEFT, RTGS, and IMPS. You can typically find the IFSC code on your bank account passbook, cheque leaf, or the RBI website.

How to Find an IFSC Code?

There are several ways to locate an IFSC code:

- Cheque Leaf and Passbook: The IFSC code is printed on your cheque leaf and passbook.

- RBI Website: The RBI's website provides a list of IFSC codes for all banks and their branches.

- Bank's Official Website: Most banks list their IFSC codes on their official websites.

Benefits of IFSC Code

- Identification: Helps in identifying the bank and its specific branch.

- Accuracy: Reduces errors in fund transfers.

- Efficiency: Ensures accurate processing of NEFT, RTGS, and IMPS transactions.

Benefits of MICR Code

MICR codes facilitate the quick and error-free processing of cheques using magnetic ink and specialized reading technology.

Details of Fund Transfers Using IFSC

Transaction Charges::

| Amount | NEFT | RTGS | IMPS |

|---|---|---|---|

| Up to Rs. 10,000 | Rs. 2.50 | Min. Rs. 2 Lakhs | Rs. 5.00 |

| Rs. 10,000 - 2 Lakhs | Rs. 15.00 | Rs. 26 | Rs. 10.00 |

| Above Rs. 2 Lakhs | Rs. 25.00 | Rs. 51 | Rs. 15.00 |

*Charges are indicative and may vary. Check with your bank for specific fees.*

- NEFT: Available from 8 A.M. to 7 P.M. on weekdays.

- RTGS: Available from 9 A.M. to 4:30 P.M. on weekdays.

- IMPS: Available 24/7, 365 days a year.

How to Transfer Money Using IFSC Code

To transfer money using an IFSC code:

- Identify the Bank and Branch: The first four digits of the IFSC code denote the bank (e.g., ICICI for ICICI Bank), while the last six digits specify the branch.

- Provide Details: During the fund transfer, you need to provide the bank name, branch, account number, and IFSC code of the payee.

- Complete Transfer: Fund transfers are completed securely and quickly once all details are provided.

Transferring Funds via SMS

- Register Mobile Number: Link your mobile number to your bank account by registering for mobile banking services.

- Obtain MMID and mPin: After registration, you'll receive a unique 7-digit MMID and mPin.

- Send SMS: Create an SMS with "IMPS" followed by payee details and amount. Send this SMS after confirming the transaction and entering your mPin.

- Confirm Transfer: Enter your mPin when prompted to complete the transaction.

Difference Between IFSC and MICR Code

| Feature | IFSC Code | MICR Code |

|---|---|---|

| Purpose | Facilitates electronic fund transfers. | Speeds up cheque processing. |

| Format | 11-character alphanumeric code. | 9-digit numeric code. |

| Structure | First 4 characters are the bank code; last 6 are the branch code. | First 3 digits are city code; next 3 are bank code; last 3 are branch code. |

| Usage | Used for online transactions (NEFT, RTGS, IMPS). | Used for processing physical cheques. |

Both IFSC and MICR codes are crucial for their respective roles in banking transactions—IFSC for electronic transfers and MICR for cheque processing.